Table Of Content

- Who pays for the home appraisal?

- What Will My Home Appraise For? Here’s How to Check Your Home’s Value

- How much is a home appraisal and who pays for it?

- Home inspection vs. appraisal

- Home appraisal vs. home inspection

- Provide Comparable Properties

- Navigating Utah Home Inspections: A Guide for Homebuyers

- Do all types of home appraisals cost the same?

An appraiser will conduct a visual inspection of the home and look at recent home sales in the area, known as comparables or comps. Based on the information gathered, the appraiser will determine the home’s value. As a rule of thumb, the larger the home, the more expensive the appraisal. A larger home will take more time to evaluate and results in a more extensive report. As a general reference point, properties priced at or less than $500,000 will typically result in an appraisal cost at the lower end of the range.

Who pays for the home appraisal?

The Top 7 Renovations That Increase Home Value In 2023 - Bankrate.com

The Top 7 Renovations That Increase Home Value In 2023.

Posted: Fri, 05 May 2023 07:00:00 GMT [source]

If the seller accepts the offer with those conditions, buyers don’t have to worry about that fee. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

What Will My Home Appraise For? Here’s How to Check Your Home’s Value

An important part of the appraiser’s value determination is the price of comparable homes sold recently in the property market. The most relevant ones have many of the same characteristics as the home in question and are in the neighborhood or one nearby. Appraisal visits for government-backed loans can differ from those for conventional loans. For example, an appraiser who is compiling a report for an FHA-backed loan needs to test utilities and appliances to make sure they are in working order, per government rules.

How much is a home appraisal and who pays for it?

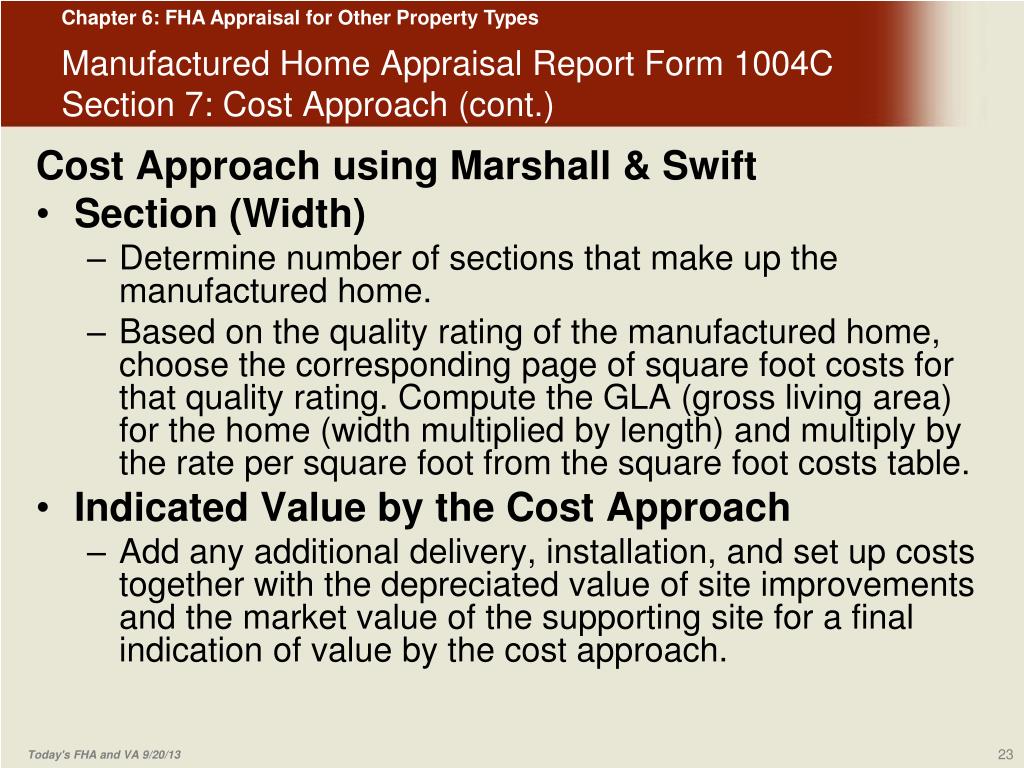

Mobile homes are also known as manufactured homes because they are built in a factory and then moved via truck to a lot or property. Since many people who have mobile homes also have land surrounding the home, the cost varies. Mobile homes will be appraised in a similar manner as single-family homes, though they are often less square footage, which can sometimes make the overall costs less. A property appraisal cost has several factors that contribute to the fee. Many times, smaller properties equate to a lower price for the appraisal. Keep in mind that there are other components, but the size is a larger part of the fee.

Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. A professional appraiser’s fees are regulated in part by federal law — the Dodd-Frank Wall Street Reform and Consumer Protection Act — and must be reasonable and customary for the geographic market. Before you have a home appraised, know the four important factors that can affect the cost of your home appraisal. Obviously, upgrading or renovating increases the appraised value of your home when you are refinancing. Making sure the house is clean, well-organized, and free of clutter also helps. The Income Approach Appraisal is generally used for income-producing properties, like rent houses.

The FHA's Minimum Property Standards - Investopedia

The FHA's Minimum Property Standards.

Posted: Sat, 25 Mar 2017 19:27:02 GMT [source]

Home appraisal vs. home inspection

Examples include a snow-covered roof or locating a well and septic that aren’t marked on the property sketch. Let’s take a look at the main factors that impact the cost of a home appraisal as well as what to expect from the process. Angi pegs the average cost of a home appraisal at $356, but the National Association of Realtors®’ (NAR) 2023 Appraisal Survey suggests that it’s more like $500. Costs will vary based on what area of the country you live in, the type of home, its square footage, condition, and more.

Mortgage rates reached a peak of 18.6% in October 1981, although home prices were considerably lower, even on an inflation-adjusted basis, than today's values. The median U.S. home sale price — what buyers actually paid for a property — also hit a record in April, reaching $383,725, Redfin said, with its data going back to 2015. Sale prices combined with current mortgage rates pushed the median mortgage payment to a record $2,843, up nearly 13% from a year ago, it added. A home appraisal is an official estimate of the fair market value of a home. It must be conducted by a licensed and impartial professional appraiser who uses information about the home, the surrounding neighborhood and recent nearby sales to determine a home’s value.

The appraiser evaluates how much the house is worth based on comparable properties in the area and adds extra features that create value. Homebuyers use the appraisal to determine if the pricing on the house is fair and reasonable. Sellers often have an appraisal done to make certain they have the correct pricing for their home.

More likely, homeowners and real estate agents may use it to help determine a home’s listing price. If you are listing your home through a real estate agent, the price you have on the house is fairly on point. If this happens, the homeowner can write a letter and ask for an appeal. Keep in mind that this will only work if there is proof that the original appraisal was incorrect.

Lenders generally require an appraisal to be performed during the mortgage process so they can properly judge the risk of approving your application. Note that while the lender will typically order an appraisal, the home buyer will foot the bill. The shortage of home appraisers caused delays during the pandemic housing boom as demand outstripped supply. That’s not as much of a concern in the 2024 market as home sales have moderated and appraisal timelines are back to normal. Only 14% of respondents to NAR’s 2023 Appraisal Survey reported delays in completing appraisals in their markets, down from 35% in 2022.

An appraiser might assume the dishwasher is working if it’s not visibly leaking, for example, but a home inspector would run it to confirm it functions properly. The home inspection evaluates the property’s safety and structural soundness; the home appraisal evaluates its value. They will also consider the local market conditions and the overall economy. Although the outcome of the real estate appraisal is always to come up with a fair value, the approach used is often different based on the type of property. Whether comparing an existing home, a new home, or an income-producing property, the methods vary.

Their primary focus is to determine whether a home is in a livable condition. If the house is deemed unsafe, its appraisal value could be much lower than expected. Getting an appraisal can be nerve-wracking, especially if you aren’t sure of the factors that are involved.

A seller may wish to have one to properly value their home for sale, while buyers may want a preliminary inspection to see if the price is in line before they apply for financing. If the lender is ordering the evaluation, they choose who will perform it. Before the appraisal or any other money is spent, the lender provides the buyer with a loan estimate and closing disclosure so that all upfront and closing fees will be known ahead of time. Modular homes run the same square footage as single-family homes and are often constructed on similar plots of land.

This is by far the most common form of house evaluation still used and the one most often required when obtaining a mortgage for a home. With this type of process, there will be a complete onsite evaluation of the home, the property, and the neighborhood to draw an accurate price. Since this is the most accurate and time-consuming type of evaluation, it comes with a higher price tag. During the process, the appraiser collects data on the interior and exterior of the home, including the condition, and compares it with recent sales in the area to determine the value. A home appraisal is conducted by a licensed professional to determine what your home is worth.

She is a regular contributor to multiple financial publications, and her work has been syndicated nationwide. For example, if you bought a home for $300,000 two years ago and it’s now valued at $290,000, it will cut the equity you have in your home. The new loan-to-value figure might affect your interest rate and whether you need to get mortgage insurance. Homeowners who are refinancing need to make sure the appraised value hasn’t slipped since they bought the home. Their current mortgage is based on that previous value, so a decrease could possibly make the bid for a new mortgage more complicated or not possible.

This website provides current year and delinquent secured tax information. Delinquent Secured Tax information is available all year except during the month of July. Gambino said the Glassell Park area where the home is located is popular among artists, musicians and actors. The Assessment Appeals Board’s decision can result in a decrease, increase, or no change in your property’s assessed value. Zhao added, "My advice for serious buyers who can afford today's costs is to shop for your dream home and accept that this year is probably not the time to find a dream deal."

No comments:

Post a Comment